IN State Form 44954 2013-2025 free printable template

Show details

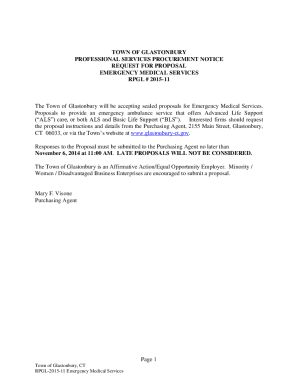

EMPLOYER S CONTRIBUTION QUARTERLY ADJUSTMENT REPORT FOR AMENDED PURPOSES ONLY State Form 44954 R4 / 5-11 INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT 10 N SENATE AVE RM SE201 INDIANAPOLIS IN 46204-2277 Local 317-232-7436 Toll Free 1-800-437-9136 Fax 317-233-2706 CONFIDENTIAL RECORD Pursuant to IC 22-4-19-6 IC 4-1-6 Employer Name Account Number Street Address Federal Number City State ZIP Code Telephone UC-1 Date Qtr. Ended Tax Rate Gross Wages Exc...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN State Form 44954

Edit your IN State Form 44954 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN State Form 44954 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN State Form 44954 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IN State Form 44954. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN State Form 44954 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN State Form 44954

How to fill out IN State Form 44954

01

Obtain a copy of IN State Form 44954 from the appropriate state agency website or office.

02

Read the instructions carefully to understand the required information.

03

Fill in your personal information, including your name, address, and contact details in the designated sections.

04

Provide any necessary identification numbers as requested, such as Social Security Number or Tax ID.

05

Complete any additional sections relevant to your specific situation, following the prompts closely.

06

Review the form for accuracy and completeness before submission.

07

Sign and date the form in the designated area.

08

Submit the completed form according to the instructions, whether by mail, in person, or electronically.

Who needs IN State Form 44954?

01

Individuals or businesses who are applying for specific state-related benefits or services in Indiana.

02

Taxpayers who need to report certain information to the state government.

03

Residents seeking specific permits or licenses that require the completion of this form.

Fill

form

: Try Risk Free

People Also Ask about

How do I appeal an overpayment on unemployment in Indiana?

To File Your Appeal Mail the appeal to 10 North Senate Avenue, Indianapolis, IN 46204; Fax the appeal to (317) 233-6888; Deliver the appeal in person to the Department at 10 N. Senate Ave., Indianapolis, IN 46204. Tell the Indiana Department of Workforce Development representative that you want to file an appeal.

Is Indiana waiving unemployment overpayments?

After nearly a year of demanding answers from the Department of Workforce Development on why thousands of Hoosiers were being asked to repay unemployment benefits they were eligible to receive, the department says they have waived $7.3-million in unemployment overpayments since September 2020.

What is proof of employment for Pua in Indiana?

Proof of employment can include: paycheck stubs, • earnings and leave statements showing the employer's name and address, and • W-2 forms when available.

How do I file a voucher for Indiana unemployment?

You must file a voucher WEEKLY through the online filing system (called Uplink). Submit your weekly voucher the week following your initial application and each week thereafter. Benefits are paid weekly. The week runs from Sunday, 12:00 a.m. to Saturday, 8:59 p.m. Eastern time.

Can you go to jail for unemployment overpayment Indiana?

Indiana penalties Up to eight years in prison. 25% the overpayment amount in fines for the first case of fraud, 50% for the second case of fraud, and 100% for third and subsequent instances of fraud. Pay restitution (pay back the unlawful unemployment insurance benefits received) State tax return garnishment.

Does Indiana unemployment back pay?

INDIANAPOLIS – Hoosiers who have been waiting several weeks for the federal pandemic unemployment benefits to resume will receive back pay to cover the weeks they were eligible and were not paid, ing to the Indiana Department of Workforce Development.

How do I get my Indiana unemployment tax form?

Form 1099-G will be available on claimants' Uplink CSS Correspondence pages by Feb. 1, 2023. Once it is available, you can access your Form 1099-G information on your Correspondence page in your Uplink account. We will mail you a paper Form 1099-G if you have opted into paper mailing or are a telephone filer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IN State Form 44954?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the IN State Form 44954 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out IN State Form 44954 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign IN State Form 44954. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I edit IN State Form 44954 on an iOS device?

Create, edit, and share IN State Form 44954 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is IN State Form 44954?

IN State Form 44954 is a tax form used in Indiana for reporting certain types of income and calculating the associated tax obligations.

Who is required to file IN State Form 44954?

Individuals and entities in Indiana who have specific types of income that need to be reported for tax purposes are required to file IN State Form 44954.

How to fill out IN State Form 44954?

To fill out IN State Form 44954, gather all necessary financial documents, enter your personal information, report all relevant income details, and calculate the tax due based on the instructions provided on the form.

What is the purpose of IN State Form 44954?

The purpose of IN State Form 44954 is to provide a standardized method for reporting specific income and calculating tax due to the state of Indiana.

What information must be reported on IN State Form 44954?

The information that must be reported on IN State Form 44954 includes personal identification details, specific types of income, deductions, and any tax credits that may apply.

Fill out your IN State Form 44954 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN State Form 44954 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.